The desire to buy at a discount then watch the market improve and increase the property’s value is something we hear about during times like these. We feel a noticeable shift, home values are reducing, and there is less competition in the market. This has been the tale of 2022, and we see data in other ways than just looking at graphs. Whether it’s our sewer inspector telling us he’s doing 1/3 of the volume he was during the recent peak, or our lenders telling us new home loan applications have drastically reduced, we see it everywhere.

The difficulty for much of the conversation around buyers waiting for the market to crash is being able to know when it has sufficiently crashed. Some people think due to low supply, it won’t. Others think it will, and some think it already has. What defines a crash? Are we through the worst of it?

There are internet memes conveying that monthly payments are now the same as they were when interest rates were 3% because the homes are selling for under list price. This is far too broad of a generalization to make since pricing strategy is such a variable. Maybe a seller wants to price aggressively and sell fast, or maybe they want to test the market. Memes and media like this can easily create false assumptions of the market.

Suppose you are considering waiting for the market to crash. My question would be – what metrics are you looking at to define what you would consider to be a sufficient downturn? Is there a price target that you have in mind for a particular sized home in a particular neighborhood? And if that crash occurs, will you have the discipline to buy when your price becomes available? Like buying a stock, it’s hard to buy on a downward trend. The temptation of waiting to see if it crashes further is huge.

I’ll wrap up with one data point that resonated with me recently.

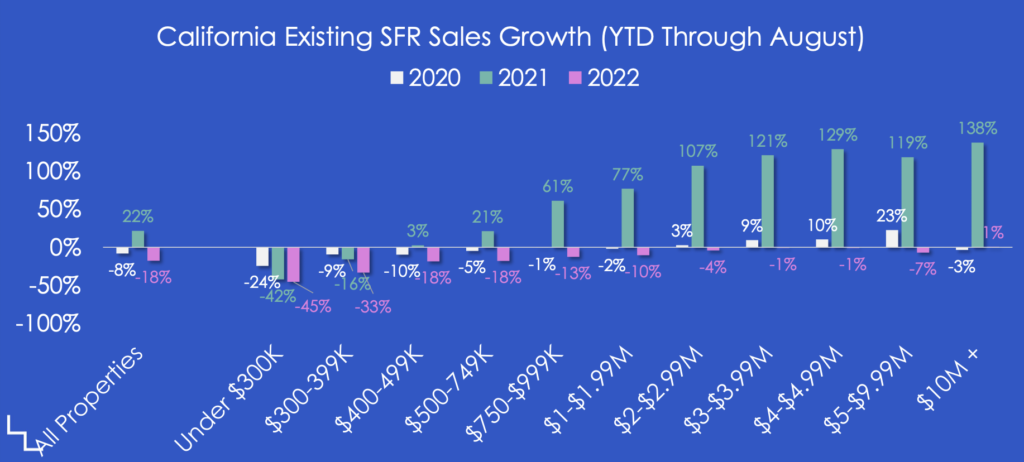

This graph from the California Association of Realtors shows that home sale volume at every price point in the California market has reduced in 2022 with the exception of one – the ultra luxury real estate market 10M and up. If you look closely you’ll see the pink “1%” indicating that part of our California market is up 1% this year. It’s much less of an increase than 2021’s 138% increase from the year before, but it’s still up while sales volume is down in every other category. Ultra wealthy buyers are taking advantage of the fear in the market with intent to hold great properties long term. Maybe they’re timing it perfectly, maybe they’re not – we probably won’t know for a while, but one thing is certain. They are taking action!